38 pricing zero coupon bonds

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price? - DQYDJ Zero coupon bonds have a duration equal to their time until maturity, unlike bonds which pay coupons. Duration of a bond is a length of time representing how sensitive a bond is to changes in interest rates. Since zero coupon bonds have an equal duration and maturity, interest rate changes have more effect on zero coupon bonds than regular ... Zero Coupon Bond: Formula & Examples - Study.com The prices of zero-coupon bonds are more volatile compared to coupon bonds. Pricing. Maturity dates and interest rates dictate the price of zero coupon bonds. When interest rates are higher, the ...

News and Insights | Nasdaq Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more

Pricing zero coupon bonds

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year. Zero Coupon Bond: Definition, Features & Formula When pricing a zero-coupon bond, you can use the following formula: PoB = FV / (1+r)n Where: PoB = Price of Bond FV = Face value - the future value or maturity value of the bond r = the required rate of return or interest rate n = the number of years until maturity The interest rate is assumed to be compounded annually in the formula above. › terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

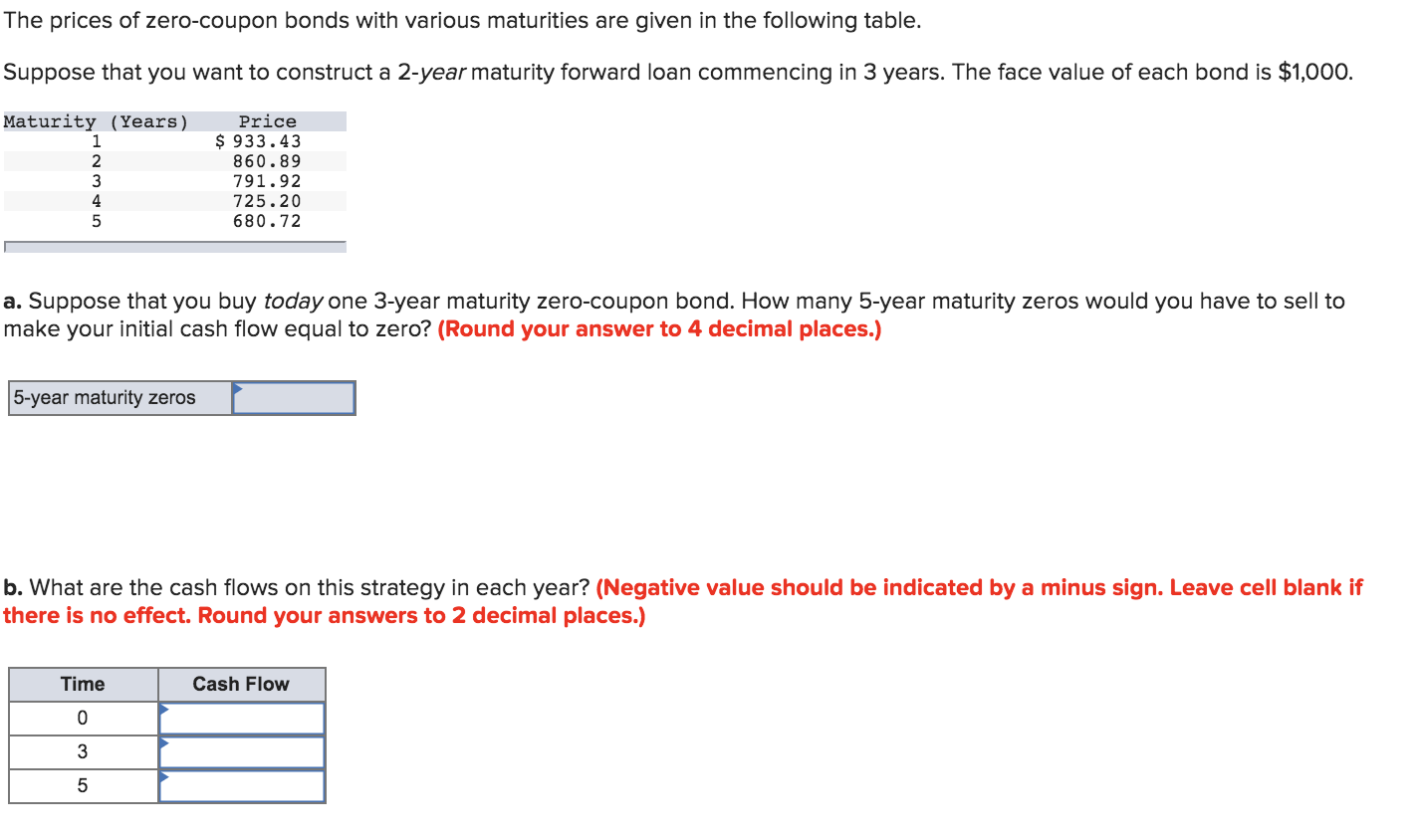

Pricing zero coupon bonds. The One-Minute Guide to Zero Coupon Bonds | FINRA.org For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. For this reason, zero-coupon bonds are often purchased to meet a future expense such as college costs or an anticipated expenditure in retirement. Domestic bonds: FHLB, 0% 20dec2021, USD (364D) Issue Information Domestic bonds FHLB, 0% 20dec2021, USD (364D). Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings. Eng. Pol Ita Deu Esp Chn ... Zero-coupon bonds Senior Unsecured Amortization ... Prices of zero-coupon bonds reveal the following | Chegg.com Question: Prices of zero-coupon bonds reveal the following pattern of forward rates: In addition to the zero-coupon bond, investors also may purchase a 3-year bond making annual payments of \( \$ 50 \) with par value \( \$ 1,000 \). a. What is the price of the coupon bond? (Do not round intermediate calculations. Round your answer to 2 decimal ... Invest in G-SEC STRIPS India - Bondsindia.com Let’s understand the pricing better with the help of an example. The face value of a G-Strip Bond is Rs 1000. The bond bears a coupon rate of 9% with coupon payments being made at the end of each year. The maturity of the bond is 4 years. If the bond is redeemable at a premium of 11%. What would be the present market price of the bond?

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ... en.wikipedia.org › wiki › United_States_TreasuryUnited States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006. Bond Pricing - Formula, How to Calculate a Bond's Price For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. Zero-coupon bonds are typically priced lower than bonds with coupons. Bond Pricing: Principal/Par Value Each bond must come with a par value that is repaid at maturity.

› knowledge › zero-coupon-bondZero-Coupon Bonds: Characteristics and Calculation Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a “T-Bill,” a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula Zero Coupon Bond - Explained - The Business Professor, LLC Calculating the Price of a Bond. Below is the formula for calculating the present value of a zero coupon bond: Price = M / (1 + r)^n where M = the date of maturity r = Interest Rate n = # of Years until Maturity If an investor wishes to make a 4% return on a bond with $10,000 par value due to mature in 2 years, he will be willing to pay ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate 31.05.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Fixed Income Pricing - Fixed Income | Charles Schwab Access Schwab's low and straightforward pricing and choose from hundreds of no-load, no-transaction-fee bond mutual funds. ... Zero-coupon Treasuries (including STRIPS) Pricing $1 per bond online $10 minimum, $250 maximum online** Broker-assisted trades: Online fee plus $25. Products Treasuries - new issues and secondary trades Treasury bills, notes, bonds Treasury …

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation.

United States Treasury security - Wikipedia Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular T-bills are commonly issued with maturity dates of 4, 8, 13, 17, 26 and 52 weeks, each of these approximating a different …

The Zero Coupon Bond: Pricing and Charactertistics Calculating the Price of a Zero Coupon Bond The basic math is easy. What should an investor pay for the 1-year coupon? If the investor demands a 4% return over a one-year period, she should pay something around $96 for the $100 maturity value (actually $96.154 since we're starting at less than $100).

Zero Coupon Bond Definition and Example | Investing Answers Calculating the Price of a Zero Coupon Bond The price of a zero-coupon bond can be calculated by using the following formula: where: M = maturity (or face) value r = investor's required annual yield / 2 n = number of years until maturity x 2 P = Price

Bond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond …

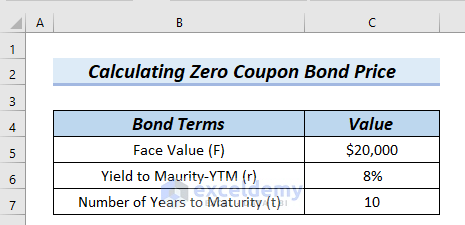

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww The annually Zero Coupon Bond and the semi-annual Zero Coupon Bond can be measured using two simple formulas, which are mentioned below: Price of Zero Coupon Bond calculated annually Price of Zero Coupon Bond calculated semi-annually In both the formulas: Face value = Future value or maturity value of the bond

Coupon Bond Vs. Zero Coupon Bond: What's the Difference? 31.08.2020 · Zero-Coupon Bonds and Taxes . Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of ...

en.wikipedia.org › wiki › Mortgage-backed_securityMortgage-backed security - Wikipedia A mortgage-backed security (MBS) is a type of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment bank) that securitizes, or packages, the loans together into a security that investors can buy.

How to Calculate the Price of a Zero Coupon Bond The lower the price you pay for the zero-coupon bond, the higher your rate of return will be. For example, if a bond has a face value of $1,000, you'll earn a higher rate of return if you can buy it for $900 instead of $920. Calculating Zero-Coupon Bond Price.

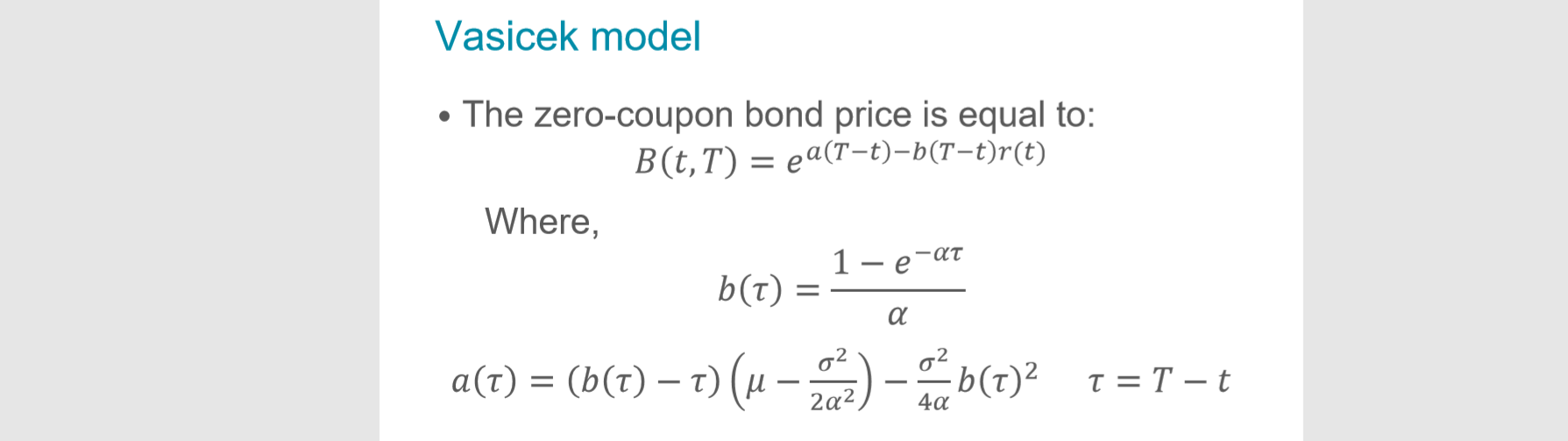

Pricing of zero-coupon bond options - Big Chemical Encyclopedia Pricing of zero-coupon bond options. Starting from the risk-neutral bond price dynamics (5.4), we derive the well known closed-form solution for the price of a zero-coupon bond option. Thus, as shown in section (2.1) the price of a call option on a discount bond is given by [Pg.44] the abiUty to derive a closed-form of t z) crucially depends on ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Perhaps the most familiar zero-coupon bonds for many investors are the old Series EE savings bonds, which were often given as gifts to small children. These bonds were popular because...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

› fixed-income › pricingFixed Income Pricing - Fixed Income | Charles Schwab Schwab uses the same pricing schedule for sell orders, which must be placed through a broker and are subject to a $25 broker-assisted transaction fee. Large block transactions (orders of more than 250 bonds) may be eligible for special handling and/or pricing—please call for information.

What are Zero-coupon Bonds? Price of the zero coupon bond = Face Value/1/ (1+r/2) ^ (2n) If the maturity value of the bond is Rs 25,000 and the interest rate is 6% P.A., and the period is 3 years, our purchase price of the zero coupon bond would be Rs 20,991 using the above formula. This is calculated as below:

How Premium Bonds are Priced | Zero Coupon Bond | Savings - PFhub Pricing a Zero Coupon Bond. A zero coupon bond does not make any interest payments throughout the life of the bond. There is only a single cash flow, at the time of maturity of the bond, when the par value of the bond is returned to the investors. Pricing such a bond is much simpler. Let's consider a zero coupon bond with a par value of ...

What is a Zero Coupon Bond? Who Should Invest? | Scripbox How is the price calculated for a zero coupon bond? The price of a zero coupon bond is calculated using the YTM formula. If the above formula is rearranged to calculate for the price, then the market price of the bond will be: Present value = ( Face value / (1+YTM)^n) - 1

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ Zero coupon bonds are particularly sensitive to interest rates, so they are also sensitive to inflation risks. Inflation both erodes the value of the dollars the bond will eventually pay. In the United States, you need to impute the interest for some zero coupon bonds to pay taxes in the current year (possibly also for state or local taxes). One tax workaround is to purchase zero …

Zero Coupon Bond Calculator - Nerd Counter There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. So, the under the given procedure will be applied to have the demanded answer easily: $4000 (1+.3)20; $4000; 190.049637748; $21.05

Zero-Coupon Bond - Definition, How It Works, Formula Pricing Zero-Coupon Bonds To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually.

Zero-Coupon Bonds: Characteristics and Calculation - Wall Street … One drawback to zero-coupon bonds is their pricing sensitivity based on the prevailing market interest rate conditions. Bond prices and interest rates have an “inverse” relationship with one another: Declining Interest Rates Higher Bond Prices; Rising Interest Rates Lower Bond Prices; The prices of zero-coupon bonds tend to fluctuate based on the current interest rate …

How to Buy Zero Coupon Bonds | Finance - Zacks The less you pay for a zero coupon bond, the higher the yield. A bond with a face value of $1,000 purchased for $600 will yield $400 at maturity. Zero coupon bonds are issued by the...

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

› terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

› terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero Coupon Bond: Definition, Features & Formula When pricing a zero-coupon bond, you can use the following formula: PoB = FV / (1+r)n Where: PoB = Price of Bond FV = Face value - the future value or maturity value of the bond r = the required rate of return or interest rate n = the number of years until maturity The interest rate is assumed to be compounded annually in the formula above.

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

Post a Comment for "38 pricing zero coupon bonds"